Car Insurance No Claim Bonus (NCB) – Important things every car owner must know

Summary –

In motor car insurance when you pay annual premium you are availing a financial protection from any damage during an accident or a mishap. If you drove your car with care and not make any claim for a year or more you make use of No Claim bonus offered by insurer as it reduces your premium amount in subsequent years. In case you choose to sell your car you can still retain the bonus for future use while buying a new car.

Brief –

When you drive your motor car carefully and safely the insurance company at the time of renewing your Insurance policy rewards you each year with no claim bonus (NCB). If you didn’t make claim during the year then you are recognized as no financial burden giver to the insurer and the reward also encourages the insured to avoid raising claim for minor issues. NCB has been one of the ways which reduces your Insurance premium for the car year on year.

NCB can reduce your OD premium by up to 50%:

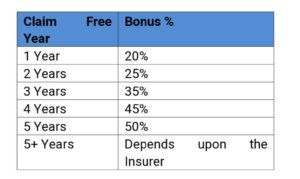

The maximum NCB discount offered by insurer stands at 50%, which you earn by the end of five years of making no claims. If you’ve already earned the 50% discount, you will not be applicable to earn further discounts even if you cross another no-claim year but it continues to stay so. If you decide to sell the car which has earned this NCB and buy a new car the 50% NCB is calculated on the OD premium of the new car which would make a huge difference in your overall insurance premium especially when you buy high end cars.

The general NCB grid for a Motor Insurance policy is –

NCB is not calculated on your entire insurance premium amount

NCB discount is not applicable for third-party liability insurance premium, which is the basic cover that is mandatory by law. Usually, third-party liability insurance premium accounts for up to 20% of the total premium amount. So, the earned NCB percentage will be calculated on the total premium minus the third-party liability premium. This is important, as car owners often wonder if there’s a calculation error as they usually calculate the NCB on the total premium and feel they have received an insufficient discount.

What happens when you decide to sell the Car?

NCB is given to the policy holder and not to the vehicle. So for example if you have accumulated 45% of your bonus in 4 years of no claims and decide to sell the car you have 2 options –

1) Use the NCB of the car that you selling to buy the new car which would reduce the premium drastically on the new one. The% of applicable NCB is calculated on Own Damage premium of the new car.

2) Sell the car and hold on to the NCB preserving letter /certificate issued by Insurer which has validity of 3 years from the date of expiry of the previous insurance or the date of transfer of insurance. The NCB preserving letter is a certificate issued by an insurer on its letterhead which shall mention the following –

Insured’s name, vehicle registration number, NCB Confirmation under policy number, period of issuance, NCB entitled %, NCB period available period etc.

However, note that NCB is not transferred to one person from another unless the owner of the car passes away and the car is passed on to the heir.

Global NCB Preserving letter

In case you earned NCB abroad an insured may be granted NCB on new policy taken out in India as per entitlement abroad, provided the policy is taken in India with 3 years of expiry of the overseas insurance policy, subject to relevant provisions of NCB under these rules.

So next time when you are selling your old car and planning to buy a new one make use of the NCB to reduce your premium in the new Insurance policy.

Data – India Motor Tariff – GR.27 and policy wordings of Tata AIG Comprehensive Motor Car Insurance policy

Leave a Reply