How do Debt Funds generate returns?

A recently acquired client forwarded me a marketing message of NFO of a Medium-Term Bond Fund (Fund with a Macaulay duration of 3 to 4 years) launched by a Bank-sponsored AMC.

I promptly replied no to investing in the NFO and the AMC and he was keen to know the reasons. On prodding, he said that a relative worked in the Bank and he had to oblige him. The Banker had told my client that he would get a return of 8 – 9% p.a. in the next year and upto 12% p.a. over the next 3 to 5 years from this fund. Shocking!

This though made me think – do investors understand how returns are generated in Debt Funds?

Any Debt Fund has two components of Returns:

(1) Price Movement of the Bonds and

(2) Accrual of Coupon Income

Both, alongwith the Total Expense Ratio (TER) of the Fund constitute the calculation of the Net Asset Value (NAV) of the Fund through the following Formula:

(1) Price Movement of Bonds:

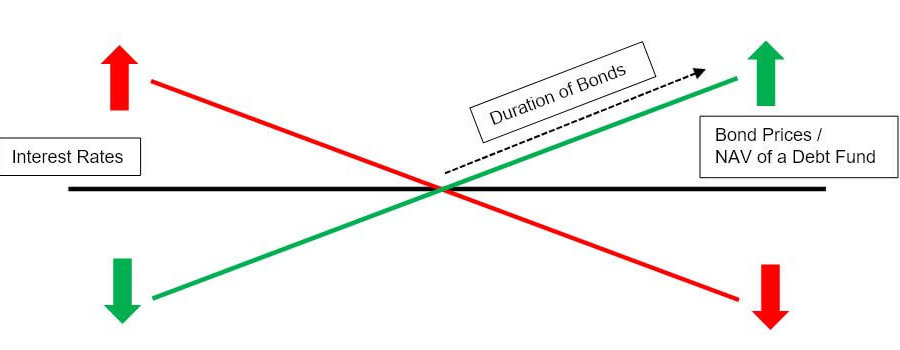

The Market Value of Bonds is the function of the Interest rate environment in the economy and there exists an inverse relationship between the Interest Rates and the Bond Prices. If the Interest Rates were to rise, the Bond Prices (and thereby the NAV of the Fund) will fall and vice versa.

In a rising / falling / volatile interest rate environment, this component will have a higher bearing on the returns of the Fund, especially for longer Duration Bonds.

(2) Accrual of Coupon Income:

In a steady interest rate environment, Accrual of Income will be the predominant source of returns in a Debt Fund.

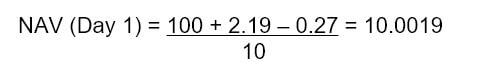

Accrual refers to the process of regularly recognizing the Coupon (Interest) income. Let us take an example of a fund that has a NAV of Rs. 10/- on Day 0, has invested Rs. 100/- in a Bond with annual coupon of 8% and TER of 1% p.a.

The Bond will pay interest of Rs. 8/- at the end of 1 year. Under the accrual process, Fund will recognize income and expenses daily by dividing Rs. 8/- (income) and Rs. 1/- (expense) by 365.

Thus, the NAV of the Fund at the end of day 1 (assuming no new units are further created and there is no change in the Market Value of the Bonds) will be computed as:

Continuing the same process for one year, the Fund’s NAV will reach Rs. 10.70 / unit. Thus, the Investor will make a return of 0.70 / unit (NAV at year end of Rs. 10.70 – Starting NAV of Rs. 10.00), which translates to 7% p.a.

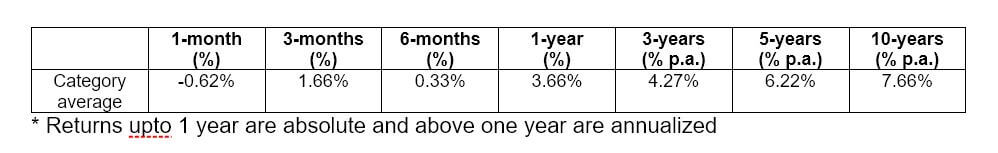

Let us now understand some key statistics of all the existing Medium-Term Bond Funds in the Industry. As on August 31, 2020, there were 16 Funds in this category with a 5-year track record and 9 with a 10-year track record. The Category average returns for different periods as on this date is as follows:

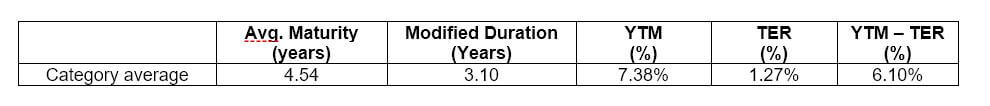

Under stable interest rate conditions, a good way to look at expected returns from a Debt Fund is to look at the Fund YTMs less the TER, assuming you hold the investment for a period close to the average maturity of the Fund.

The current category averages look like below:

Given the current numbers, could the Banker explain to me or my client as to how the new Fund likely to give an 8-9% p.a. in the next one year and 12% in the next 3 to 5 years or 3.66% for the last 1 year?.

Leave a Reply