Pay Off your mortgage in half the time

Live like no one else so you can live like no one else!

-Dave Ramsey

Being a part of an Indian middle-class family, one is usually taught to stay away from loans and minimize the use of credit. While this may be true for a few families, a lot of families actually shy away from talking about finances in front of their kids with many young adults being unaware of how to manage their money. Further, in recent times we have seen people upgrading their lifestyle as soon as they start earning their first salary and credit cards are frequently being used to spend mindlessly.

An average middle-class person has at least a home loan and usually a car loan accompanying it. Similar is the case with Mr. Mohan. He is an average 38-year-old male working with an MNC and drawing a monthly salary of Rs. 1,50,000/-. He has a 4-year-old son and a 2-year-old daughter. His wife decided to be a stay-at-home after their daughter was born. He has a housing loan, the EMI for which is around 80,000 per month. Additionally, he also has a car loan with EMIs of 20,000 per month. Currently, they don’t have any savings. They have totally ignored 2 important goals i.e. their children’s education and their own retirement.

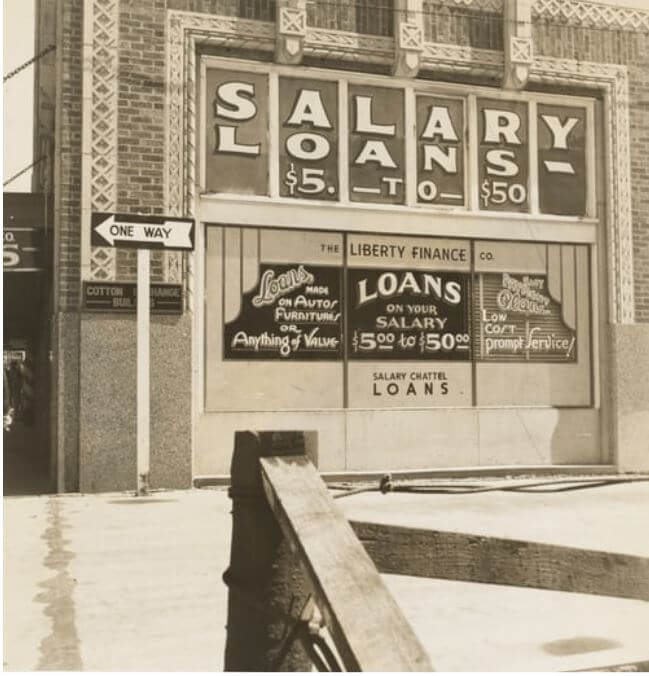

This is the story with many middle-class salaried families, who end up living from paycheck to paycheck with absolutely no room for savings. They dig themselves into a hole and don’t know how to get out. Dave Ramsey in his book “Total Money Makeover” highlights the debt trap that thousands of Americans have fallen into with mounting loans in the form of mortgage, car loan, student loan, credit card debt, etc. This growing trend is also being observed among the urban youth in India in recent times with almost everything available for sale in instalments.

So how is it that you can get yourself out of this debt trap? Here are 6 pointers that one may follow if one is looking to start living a financially healthier life.

1. Stop creating more debt: The only way to stop creating more debt is to change the habit or circumstances that led you to debt in the first place. Do not take on any more loans till you pay off the existing ones and minimize the use of credit cards.

2. Have an Emergency Fund: Building an emergency fund creates a moat so that you need not fall further into the debt trap and have enough of your own funds to take care of any unforeseen expenses that may crop up unexpectedly.

3. Try to get a lower interest rate on your loan: Speak to your credit provider or bank and try to get them to lower the interest rate on your loan. If they don’t agree to shift your loan to another credit provider or bank at a lower rate of interest.

4. Create a budget and try cutting on discretionary costs: An effective way to repay your debt early is having a monthly budget in place. You can also follow the envelope system. This means keeping cash required for variable expenses such as food, clothes etc. in an envelope and using only the allotted cash to meet these expenses for the month. Small habits like making a shopping list also help so as to avoid making unnecessary purchases.

5. Live frugally & increase your monthly payment towards your loans: Living frugally for a few years will definitely help you to pay off your loans faster by increasing the monthly payment towards your loan. Alternatively, you can also put aside money every month and pay off chunks of your loan every 2-3 years.

6. Have some extra income: Having some side hustles can generate some extra income which can be put towards repaying the loan early. This can be done by doing some jobs on the weekends or turning to a hobby to earn some income for you. You can even sell off some household items, clothes or jewelry to repay your loans early.

Leave a Reply