Minutes FPSC Offsite 10th February 2021

Prepared by Priyanka Ketkar & Supriya Kubal

Day 1: After some scrumptious breakfast, the offsite at The Retreat was kickstarted by Mr. Bhavesh Bhatt (our host for 1st half of the day) at 10am.

Speaker 1: Lisa Barbora – Time: 10.00 am to 11.15 am

Topic: Effective communication for Financial Advisors

Lisa started the session by highlighting why should we write and how writing is more effective than speaking. She then focused on how your communication changes as per the medium of communication. For eg. What you communicate on whatsapp needs to be concise and to the point. However, an email communication needs to be elaborate and more formal.

When we are writing articles, the readers should be taken into consideration. Readers want to understand both sides of a coin and then take a decision. Hence, as a writer its our job to focus on all the pros and cons of the things explained in an article. Eg. Buying vs renting decision.

Lisa then explained the six ingredients to make writing effective. They are:

- Be specific

- Be relevant

- Be flexible

- Be concise

- Be Data Centric

- Be structured

Some hygiene factors to keep in mind for good communication are:

- Salutation – Addressing the person properly

- Short form & Spelling Check – Ensure short forms are not used in written communication. Check all words for spelling mistakes

- Use of colors & underlining – This helps to highlight the important part of your communication

- Use of jargon – Jargons should be used only with relevant audience. If the audience is not aware of the jargons then the communication might fail to make the required impact

- Editing – Go through your writing atleast three times before publishing it

Writing adds value to yourself. We can use our writing to assert our values. We can say the same thing in unique and different ways. Also, we need to be honest about what we are saying. We need to talk about what people want to hear but we need to say it in our own words.

As the saying goes, ‘Practice makes man perfect’. In the same manner, with practice our writing will become effective. Finesse comes with patience. So do not be in a hurry.

Speaker 2: Bina Pandit – Time: 11.15 am to 11.30 am

Topic: Managing People Perceptions

The session was more of a stand-up comedy with audience laughing the entire 15 mins. Bina amused the participants with her witty take on the perceptions that clients have.

Perception 1: MF is very risky, stock market is not

Perception 2: LIC is the best investment

Perception 3: An investment is not legit if you do not receive a physical document

Perception 4: SIP is a product

Perception 5: Liquid funds should give market returns when markets rise

Session 3: Panel Discussion

Topic – What got you here want get you there

Panellists: Salonee Sanghvi (RIA), Gaurav Karnik (MFD but want to transition to RIA), Gajendra Kothari (MFD) and Prathiba Girish (MFD)

Moderated by Nikhil Karnik – Time: 11.45 am to 1.00 pm

Nikhil Karnik initiated the panel discussion phenomenally by showing slides on the evolution of MF Industry and which were the factors that got us here. The following points were the context of discussion:

- Aftermath of Regulations

- Evolving regulations and RIA regulations: Prathiba stated that she has been adding more clients since October ever since she stopped charging fees. Salonee was of the opinion that we need to keep educating the clients and need to give value addition to clients for the fees that RIA charged. Gaurav is an MFD currently but would like to transition to RIA in future. Gajendra’s view was, ‘Regulations are for bad guys’. If you are working for the larger good of clients, regulations will not matter.

- Changing TER: Gajendra opined that whatever is good for clients is good for us. He said currently, TERs are fair but going forward it might go down further. As our business is about compounding, its all above volumes. If TERs go down, costs will also go down. Salonee agreed with Gajendra and her focus is also on volumes. Gaurav too concurred that TERs will go south in future and we need to be prepared for it. We can leverage on technology in this. For Prathiba, focus is not on volumes. Their plan is to have maximum 150 clients. They are currently focusing on providing holistic value add service to clients. In future, Girish can take RIA license and charge clients once they get used to their service.

- Accelerating impact of digital / technology:

Gajendra would like to make himself redundant and instead make technology work for himself. Gaurav plans to make use of technology to grow 10x. His experience has been that by using technology, he has been able to make better connections with clients. Salonee is making use of technology for acquisition of clients as well as for operations. Prathiba operates from home. She was contemplating about having an office when Covid stuck. Lockdown negated the need for office. Technology has enabled to conduct effective meetings now. Previously meetings happened on WhatsApp calls. Now it’s on Zoom.

All the panelists affirmed that technology is necessary and we need to embrace it. However, human touch is equally important and can’t be completely removed.

- Constantly evolving products including the rise of Passive:

All of Gajendra’s personal money is invested in active funds. He said even in developed markets like US, 50% of the market is still in active funds. If an investor wants to get into passive funds, they can first allocate 10% of their portfolio towards passive and their make their decision after few years. He strongly believes that alpha is not created only in terms of numbers. Prathiba feels that currently alpha is possible but going forward passive is the future. Salonee said it wnt be fair to compare US and India and concurred with Prathiba that India has the potential to generate alpha. Gaurav feels that clients who have larger risk taking appetite and has the need of cost containment can take the passive route. However, the should be willing to face the consequences of passive too.

- Handling the generational shift

Salonee highlighted that the millennials do not want to invest in traditional products but want more excitement. For eg. Reits instead of real estate. Prathiba said that Gen Y knows everything. They want more of experiences. However, it is our job to make them understand that experience will not take them till the end of life. Gajendra does not focus on millennials. His ideal clients lie in the age group of 50-60. Gaurav being a millennial himself defended the experiential nature of millennials. But at the same time, he agreed with Prathiba that it will have consequences in future. So he take a middle approach with his clients wherein they can explore risky assets however with a margin of safety.

The panel discussion ended with some amazing rapid-fire questions to all panellists.

Speaker 4: Vinay Singh – Time: 1.00 pm to 1.15 pm

Topic: Client Engagement beyond Money Matters

This crisp session focused on how the speaker has been engaging with clients by doing webinars on relevant and important topics concerning clients. The bemusing part is that none of the sessions that he arranged talked about money/investments/mutual funds/etc.

Vinay Singh has formed a separate unit in his practice to educate people about money but without talking about markets. ‘Nivesh ki Paathshala’ is spearheaded by Shweta Singh, Vinay’s wife. They have been successful in conducting sessions on the topics ‘Keep your vision healthy’, ‘Relieve Pain, Regain your Life’, ‘Positive Parenting’. These topics help clients bring positivity and betterment in their life. When we help clients explore and exploit their passion, they are able to work with more and better valour, thereby leading to overall prosperity.

Foram Shah took over as host after lunch and all were geared up for two power-packed sessions

Speaker 5: Rohit Shah – Time: 2.15 pm to 3.45 pm

Topic: Happy Engagement Model

Rohit started his session with a video called ‘Monkey Illusion Business’. The video shows that those who know that an unexpected event is likely to occur are no better at noticing other unexpected events – and may be even worse – than those who are not expecting the unexpected. Long engagements mean more profit. Generally, engagements fail as expectation is not properly set by advisors.

His learnings from Non-Finance industry on client engagement:

- Project management: Communicate, communicate & communicate

- IBM Rule: The company had a rule that if an employee does not score 9/10 in managing client expectations, then he is asked to leave.

- Executive Challenge: The sales executives were asked to make 1$ additional profit by managing all other costs.

- 15k Business: A 5 star hotel charges Rs.15k per night but it’s a challenge to get Rs.15k from a client as fees. The difference is the experience that we create for clients.

- ARPU: In telecom industry, average revenue per user is tracked monthly.

Many a times, people hesitate Financial Planning because it makes things complicated on an excel. We need to renegotiate a contract and simplify things. A person cannot have only the cream (happy moments) in life. Every person will have bread (difficult situations), butter (easy situations) and cream.

A person always needs to up his game. The more value you create, more you can charge. He said whenever he does not know what to do, he turns around and asks for help.

A meeting with a client is a bridge to get over the miscommunications. So never leave a meeting and miss an opportunity. Always ask point blank questions.

Framework for Happy Engagements: PRUF

P – Proactive

R – Responsive

U – Uncomplicated

F – Fiduciary

Meeting tips:

- One should never over commit

- Never should you reschedule a meeting with client

- The ending time for a meeting should always be decided

- Reaffirm what the client said by repeating the sentence

- Always log in two minutes before the meeting time

- In the end, ask – ‘Anything else’

Rohit suggested reading Roger Gibson’s book on asset allocation and Nick Murray’s book ‘Investment Behavioural Counseller’. In his practice, he generally has 85 touchpoints with clients in a year.

He concluded his session by suggesting to be relationship focused and not transaction focused. After a transaction is over, Banks, MFs, NBFCs does not care about the client. So we can instead focus on clients and value add.

Speaker 6: Viral Bhatt – Time: 4.00 pm to 5.30 pm

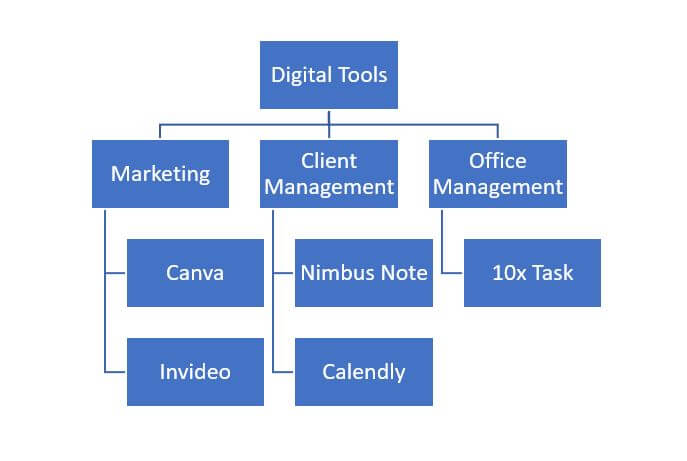

Topic: Digital Tools for Effective Business

The committee saved the best as the last session of the day. In spite of being the last session, maximum questions came during this session as participants were keen to know more about the tools that our very own #DigiViru shared. Viral demonstrated 5 simple tools that can increase the efficiency, quality, speed of our work at the same time reduce costs.

Canva: Used for creating social media posts, infographics, zoom backgrounds, newsletters, etc.

Invideo: For creating and editing videos. It has readymade templates through which we can edit and create videos

Nimbus Note: This software works as your notepad as well as an organizer. The USP of this software is that you can clip any article or images from a webpage and store it within your notes or separately.

Calendly: Calendly is an online appointment scheduling software wherein you can schedule your availability and other person can book an appointment with you based on that.

10x Task: 10x Task is a paid Indian application to manage your day to day tasks alongwith your team. It assists in tracking each & every work. You can assign tasks to team members with due dates. Same ways team members can assign tasks to others and also to self. It’s a great app to ensure tasks are getting done.

All the above tools are web-based and also have their mobile apps. (Except Invideo)

Minutes FPSC Offsite 11th February 2021

Prepared by Saanika Bhingarde

Day 2: After a night of games and fun, members were ready once again for the sessions lined up on Day 2, hosted by Archana Bhingarde

Panel Discussion

Panelists: Amit Trivedi, Kalpesh Ashar, Kartik Jhaveri and Nitesh Buddhadev

Moderator: Bhuvanaa Shreeram

Time: 10.30 am to 11.45 am

Topic: Building Your Media Presence

The Panel Discussion was conducted by Bhuvanna where she asked all panelists for their inputs on various aspects of building a media presence.

Bhuvanaa: When you started of what is it that you had in mind?

Kalpesh: Has always been passionate about being a part of mainstream media and had in fact even applied to be a part of an advertising agency and this gives an outlet to his creativity. He also believes that you have to sell yourself/project yourself in this business. This also increases credibility and client retention. He started by writing articles for publications after which he was approached to appear on TV. He believes that creativity can be exuded on any platform.

Kartik: For Kartik having a media presence happened completely by chance. In the year 2006 he used to be approached by media houses because at the time CFP was pretty new and not many people used to about financial planning. That is not the case nowadays as there are a lot of IFAs and most of them have adopted the financial planning approach to their business. He was also given paid opportunities by “moneycontrol” to write articles for them which led to media houses approaching him for appearing on their channels. However, he is of the opinion, that having a media presence does not necessarily translate into additional business but it is good for personal brand building.

Amit: A point for discussion was that there are a lot of people who are successful without a media presence. Amit believes that there isn’t a need to debate with success and agrees that it is possible to be successful without having any media presence. However, he personally enjoys the recognition that comes with his TV appearances or when his articles are printed in recognized publications. It is sort of a high that he gets. You build your own brand which is further endorsed by somebody who is already recognized (e.g Moneycontrol, Business Standard etc.)

Nitesh: He believes that we are privileged since we don’t need to depend only on mainstream media in today’s day and age as there is social media which is recognized widely by a number of people. Further, there is a lot of effort that goes in building a social media presence and also in developing content. He also believes that social media helps you build your own brand and reduces your sales cycle.

Bhuvanaa: How do you come up with a content strategy and how do you say the same thing that has already been said in an original manner?

Kalpesh: He agrees that while building content, one often ends up repeating what has already been spoken about in the past by someone else. However there are a lot of people who are not aware of the topics on personal finance we keep hearing about on a regular basis. He often uses anecdotes based on movies and cricket to connect with his audience and even with his clients in client meetings. Even in his book he has maintained linearity and believes that honesty is better than smartness. Also it is not necessary to outsource content building. Having a strong product knowledge also helps. He always brings the focus back to Financial Planning because that is the core.

Nitish: He uses Festivals, current topics and current memes to build his content around. Relevancy of content is important while repeating the same thing over and over again.

Kartik: We are living in an informational revolution where everyone is being bombarded by information especially due to social media. If one needs ideas to build content around, he suggests finding out the current trending topic from Google or the trending tweets on Twitter. He also believes that instead of giving “gyan” people prefer solutions.

Amit: Content may be repetitive, but context is new. You get context from ideas around you, which you can build content around.

Kalpesh: Though it may not generate into clients, one must keep consistently posting on their social media handles. This helps you to cement your existing clients at least. You need to give it some time as well.

In conclusion, one does not necessarily need to have a mainstream media presence as it usually does not translate into a higher sales ticket. Audiences are able to connect to content that is built around melodrama, success stories, case studies, entertainment or specific solutions.

Speaker 2: Sonesh Dedhia – Time: 12.00 pm to 12.15 pm

Topic: Build Your Brand – Grow Your Audience

Sonesh spoke about IFA Now which is a platform that has been designed to bridge the gap between clients (prospects) and advisors. Individuals who are seeking genuine advisors can find them on this platform. It is a lead generation platform for IFAs. A prospective client can find an advisor based on location. There is also a section called “Ask an expert”, where advisors can answer any questions asked by clients. Expert insights and articles written by different advisors from the fraternity are also available on this platform.

Speaker 3: Chetan Joshi – Time: 12.15 pm to 12.30 pm

Topic: Protection Prosperity in Partly Paralyzed Economy

During lockdown he and his team concentrated on selling insurance by creating opportunity from crisis. They wanted their clients to have prosperity through protection. Even though he and his team were not attending office, they were able to sell more than 100 term policies in lockdown. They were also the top distributor of health policies with ICICI Lombard in Mumbai. The lockdown period was when his team managed to get the most incentives and they were able to do an entire year’s business in just the 4 months of lockdown. Now they are asking their clients to cover themselves with Personal Accident and householder’s policies.

Speaker 4: Tivesh Shah – Time: 12.30 pm to 12.45 pm

Topic: Survey Findings

Tivesh presented the findings of the survey that was conducted with each member on various aspects of the Study Circle. Feedback was taken from members on the kind of sessions that they would like to attend in the future and the kind of speakers that they would like to hear from. Also members concerns were incorporated as part of the survey findings.

Speaker 5: Dhruv Rawani – Time: 12.45 pm to 1.00 pm

Topic: My Experiences with Clients during a lockdown

Dhruv considers himself as a student of behavioural science and likes to observe how clients react in different situations. According to him whenever clients have to book losses they become extremely uncomfortable however many years they may have been your clients. They maintain an excel sheet for tracking the actions of all clients.

Speaker 5: Sanjay Thakkar – Time: 1.00 pm to 1.15 pm

Topic: Building Rapport with Clients

Sanjay prefers meeting his clients face to face especially for the first time. It is his experience that clients open up in front of him if he shares information about himself. He believes this helps break the ice with the clients. Most of his clients are businessmen and now they’re second generation has started becoming a part of their businesses. It is important to get in touch with this second generation as this will help in client retention. He believes that ultimately how much you care about your clients matters to them.

Speaker 6: Balvir Chawla – Time: 2.15 pm to 3.30 pm

Topic: A Collaborative Business Model

Balvir has a firm in Pune where he has collaborated with 6 other IFAs and joined their practices. He explained the reasons why they decided to collaborate as there is continuity for the client – in terms of advice and service, there is a succession plan in place for them, there is a sharing of ideas and they are able to use each other’s expertise.

Their journey started in 2013 when the idea for the collaboration was formed in their minds. In 2014, they formed a company with 3 partners. Initially, they did only fresh business in Finnovators (their company), however, in 2016 they merged their AUM. In 2019 they had 2 more partners collaborating with them with the final process completion happening in February 2020. Further in October 2020, they had another 2 partners joining them taking the total number of partners to 7.

Currently, they have 4 locations in Pune and have pooled their resources.

The structure of their firm is such that each one of them is playing 3 roles which are as follows:

- As RM where they are handling the relationship of their individual clients

- Operational role in the company where technology, Compliance, accounts & finance, research, operations, manufacturer interaction, marketing and branding are taken care of. They each contribute 25% of their revenue for meeting all these expenses which are taken care by the company.

- Each of them is also a promoter and shareholder of the company.

Speaking about their progress, in 2014 when they came together, their AUM collectively was only 50 crores. In 2019, this AUM grew to 250 crores and currently stands at 650 crores. They have also managed to streamline processes by using each other’s strengths. They have put in place a succession plan considering various scenarios such as the death of the partner as well as the retirement of the partner.

There were also some challenges they had to face as they took some time to figure out the right model for their business. Each of them has a different process/ technology so combining those took them some time. Certain clients were also resistant to the change as they thought the firm would be too big and they would not get the individual attention that they were used to. Further managing partners and client’s expectations was also challenging. Their revenue and growth models also posed a problem and they had difficulty deciding on revenue distribution for businesses that could not be merged such as insurance.

In the end the members were full of questions regarding succession and collaboration and left contemplating on their own succession plans.

Speaker 7: Vishesh Gandhi – Time: 3.30 pm to 3.45 pm

Topic: Learnings from my Journey as an IFA

Vishesh had to transition from being an RM to starting out on his own as an entrepreneur. His life as an RM meant he had to look at earning his salary, targets, incentives, promotions or look for a new job again with the same cycle of salary, targets, incentives, promotion. Life as an IFA was completely different where he had to look at client acquisition and retention, goals of the client, giving unbiased advise, client reviews, different opportunities, asset allocation etc.

His journey as an entrepreneur has not been easy and he has had to face many challenges while building his career as an IFA.

However, he has managed to overcome the challenges he faced earlier to become successful as he is now serving 589 families, managing total AUM of 144 crores, has employed 7 people, has had his articles published in newspapers & magazines etc.

Leave a Reply