You know what is “Income Tax” but have you heard of “Self-Tax”?

We, as Personal Finance professionals, keep on urging people to save and invest regularly. In my experience, many people don’t prioritize disciplined saving and investing (as it is optional or so they think).

I had first sent this email to my clients/prospects in Sept 2014. It had generated a good response and translated into additional business for me. More importantly, it instilled investing discipline in some of my clients. Now, as a procedure, I send this email to all my new clients.

I am sharing the contents of the e-mail, the subject of which is, You know what is “Income Tax” but have you heard of “Self-Tax”?

I am also sharing the calculations for the numbers mentioned in the e-mail. However, I share and explain these calculations to my clients during one-on-one meetings only.

Dear X,

I am sure that you know what “Income Tax” is. You may be paying income tax to the Govt. of India. If this income tax was optional, no one would have paid it. But you are probably paying only because it is compulsory. Out of your total earnings, a portion of that earnings has to be paid to the government.

In order to pay the income tax, at times you may have made some compromises. It could have been with regards to certain luxury expenses, like buying a smaller car instead of a bigger one, postponing your vacation, buying a smaller TV than the larger one, etc. One thing is certain that you must have adjusted your expenditure based on the income that is available after paying the income tax.

Now, let me explain what “Self-Tax” is. This tax is a voluntary tax that you pay to YOURSELF. From your earnings, a portion goes towards the income tax. Out of what remains, you pay yourself “Self-Tax”. After that, the remaining amount is for you to spend. The self-tax percentage can be decided by you. However, it should not be less than 10% and it can go as high as 60%. This Self-Tax amount should be used towards long term investments of your own choice (it is recommended that you consider equity-based Mutual Fund, for these investments).

Since paying yourself is voluntary, no one usually does it diligently. But let me assure you that this self-tax will prove to be very handy after you retire. After a few months of “Self-Tax”, you will be able to adjust your expenditure based on the income available after paying both income tax and self-tax. This “Self-Tax” will become as routine as income tax.

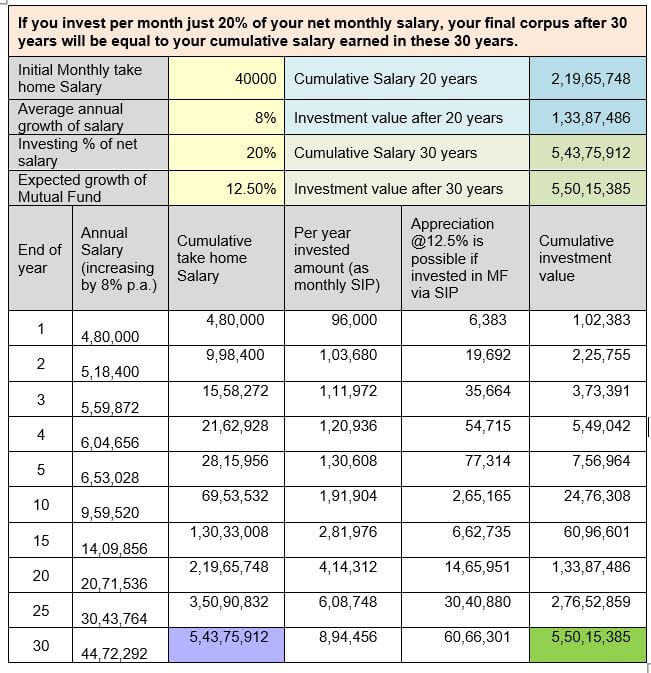

If your self-tax is just 20% of your net take-home monthly salary and if you invest this amount every month for 30 years, you will be able to accumulate a corpus equivalent to your net salary earned in these 30 years put together!! As your salary increases on every appraisal, you have to increase your investment and match it to 20% of your net take-home salary.

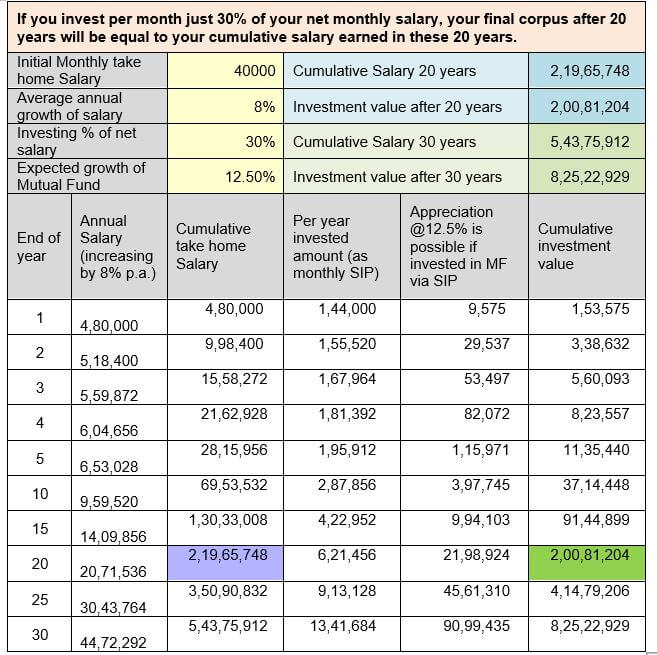

However, if you are in a position to pay “Self-Tax” at 30% of your net take-home salary, then in just 20 years, you will be able to accumulate a corpus equivalent to your net salary earned in these 20 years put together!

Now, if the government can make Income Tax compulsory, why don’t you make your self-tax compulsory (for yourself)? The Income Tax paid over the years will never come back to you. However, if you pay self-tax, it will return to you with a large bonus at the time of retirement, and it will make you financially independent.

Don’t you think that you should start paying “Self-Tax” right from this month itself?

Superb. Fantastic sirji